The Memory Squeeze

Why "Waiting it Out" is a High-Risk Strategy for 2026

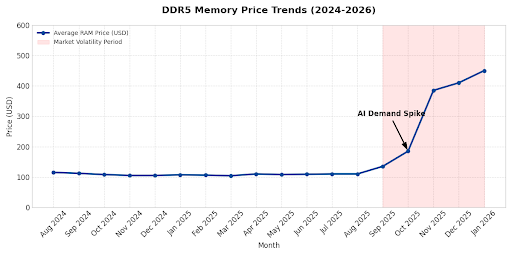

If you’ve looked at a quote for new laptops or server upgrades lately, you probably noticed a number that looks like a typo. It isn't. After years of relatively stable pricing, the memory (RAM) and storage (SSD) markets have entered a period of extreme volatility.

At K Group, we’ve been navigating technology cycles since 1980. We’ve seen "dot-com" booms and supply chain busts, but the current shift is unique because it is driven by a fundamental reallocation of global manufacturing.

The "AI Tax" on Every Device

The primary driver isn't just "inflation"-it’s the AI gold rush. Large-scale data centers and AI firms are consuming up to 70% of global DRAM production in 2026.

Because AI workloads require massive amounts of high-performance memory, manufacturers like Samsung and Micron are prioritizing these high-margin orders. This leaves the "rest of us"- standard business laptops, office desktops, and traditional servers - fighting over a dwindling supply.

Why Procrastination is the Most Expensive Option

In a typical tech cycle, we tell clients to wait for the "next big thing" to see prices drop. In 2026, the inverse is true. Here is what we are seeing on the ground:

- Shrinking Quote Validity: Pricing that used to be held for 90 days is now often valid for only 14 to 30 days.

- The "Scissor Gap": Spot prices (the cost to buy right now) are significantly higher than long-term contracts. This means as current inventory clears, the next wave of hardware will naturally be more expensive.

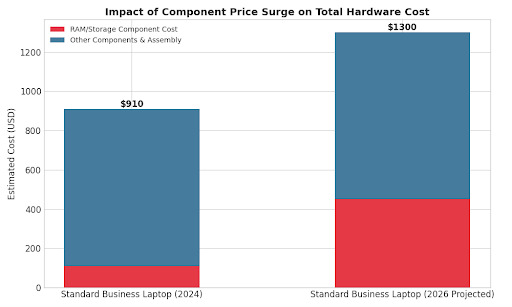

- Spec Downgrades: To keep "entry-level" prices low, many manufacturers are reducing standard RAM from 16GB back to 8GB. For a modern business environment, this is a step backward in productivity.

Strategic Recommendations

To help our partners maintain their Operational Maturity Level (OML) and protect their budgets, we suggest three shifts in strategy:

- Accelerate Necessary Refreshes: If your fleet is due for replacement in Q3 or Q4, moving that purchase to Q1 or Q2 could save 15-20% in hardware costs alone.

- Standardize High-Spec Early: Don't settle for lower RAM to save a few dollars now. The cost to upgrade that same machine six months from now will likely be double.

- Lock in "Known" Projects: If you have a facility expansion or a new department hiring, securing the infrastructure today prevents "budget creep" later in the year.

Our longevity gives us the perspective to know that while markets eventually stabilize, they rarely do so on a timeline that suits a fixed annual budget. Taking decisive action now isn't just about saving money; it’s about ensuring your team has the tools they need to stay competitive without the "sticker shock" of tomorrow.

Stop letting the market set your IT budget

If you are planning laptop refreshes, server upgrades, or new team onboarding in 2026, do not "wait and see." That is how budgets get wrecked.

Talk to K Group now to:

- pressure-test your 2026 refresh timeline

- standardize specs (so you are not forced into 8GB compromises later)

- lock pricing and availability for known projects before the next spike

The Memory Squeeze (2026)

Q1. What is the "Memory Squeeze"?

A: It is a supply and pricing crunch in RAM (DRAM) and storage (SSD/NAND) that is making everyday business hardware more expensive and harder to source predictably. Multiple industry reports tie the squeeze to AI infrastructure demand pulling manufacturing capacity away from mainstream devices.

Q2. Is this really an "AI tax" on normal laptops and servers?

A: Functionally, yes. AI data centers are buying huge volumes of memory (especially high-end DRAM used for HBM stacks), and that demand pushes cost up across the market because the same upstream capacity and components are involved.

Q3. I thought prices always come down if we wait. Why not in 2026?

A: Because this cycle is not behaving like a normal downtrend. Analysts are describing it as a structural reallocation of memory supply toward AI workloads, meaning the old "wait for the next refresh" playbook is riskier than usual.

Q4. How bad is quote volatility right now?

A: The market is moving fast enough that some suppliers and channels are shifting toward shorter quote windows and more dynamic pricing behavior than businesses are used to. In other words: if your quote feels like it has an expiration date, it probably does.

Q5. What is the "scissor gap" (spot vs contract pricing)?

A: It is the widening difference between what components cost right now (spot) and what longer-term agreements might have looked like earlier. When inventory clears, replacements can land at the new (higher) reality, and budgets get surprised.

Q6. Why are some vendors pushing 8GB RAM again, and why is that a problem?

A: When component costs climb, some manufacturers keep sticker prices "reasonable" by downgrading base specs. That can look cheaper at purchase time, but it usually costs you in productivity and forces earlier upgrades later, often at a worse price. The broader market context behind these pricing pressures is well documented across recent memory shortage coverage.

Q7. What should we do if we have refreshes planned for Q3 or Q4?

A: Move planning forward and treat memory-heavy devices (laptops, servers, SSD-heavy builds) as "buy sooner" items where possible. The point is to reduce exposure to later-year price escalation and allocation risk.

Q8. How does this connect to Operational Maturity Level (OML)?

A: If your goal is predictable operations, predictable budgeting matters. This topic ties directly to maintaining and improving Operational Maturity Level (OML) because surprise constraints (pricing, lead times, forced downgrades) create preventable operational drag.